Stamp Duty (SDLT)

Stamp Duty Land Tax (SDLT) is usually paid on increasing portions of the property price above £125,000 when you buy residential property, for example a house or flat.

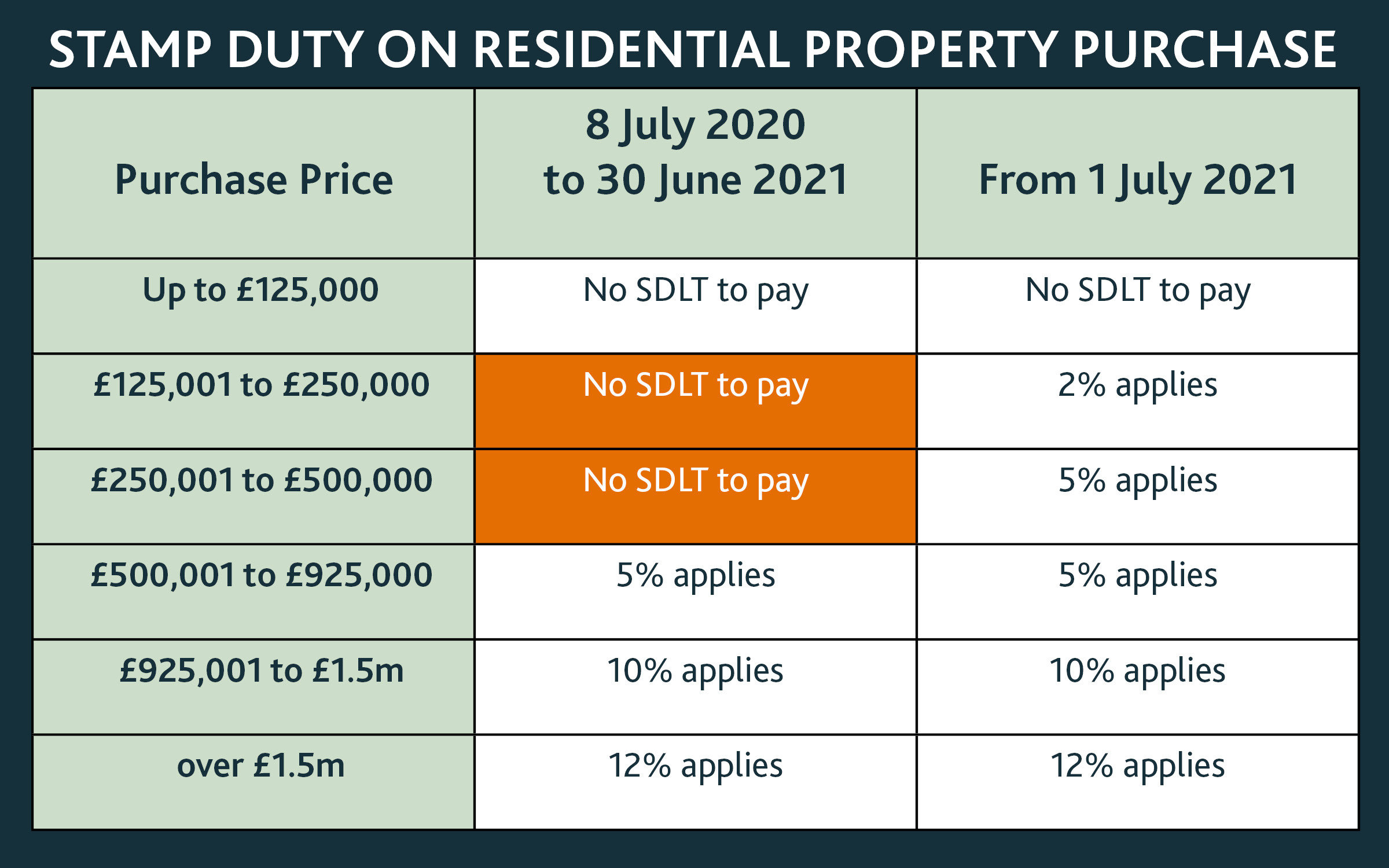

Here's the comparison chart on the 2020-2021 rates which include the Coronavirus reductions announced by The Chancellor in July 2020, including the holiday extension announced in The Chancellor's Budget on 3 March 2021:

[Note: different SDLT charges apply to leasehold and second property purchases, in addition there are first time buyer allowances.]