Employers: Government’s latest updates on flexible furlough scheme (CJRS)

Please find recent information available from the Government about the Coronavirus Job Retention Scheme (CJRS), furloughing employees and calculating wages, pensions and contributions.

For Employers:

Check if you can claim for your employees' wages through the Coronavirus Job Retention Scheme – more…

Check which employees you can put on furlough to use the Coronavirus Job Retention Scheme – more…

Find out what steps you need to take before you calculate how much you can claim for furloughed and flexibly furloughed employees – more…

Check examples to help you calculate your employee's wages, National Insurance contributions and pension contributions if you're claiming through the Coronavirus Job Retention Scheme – more…

Calculate how much you have to pay your furloughed employees for hours on furlough, how much you can claim for employer NICs and pension contributions and how much you can claim back – more…

Find out if you can claim through the Coronavirus Job Retention Scheme for individuals who are not employees – more…

Employment Solicitor and Head of Employment, Vaishali Thakerar adds:

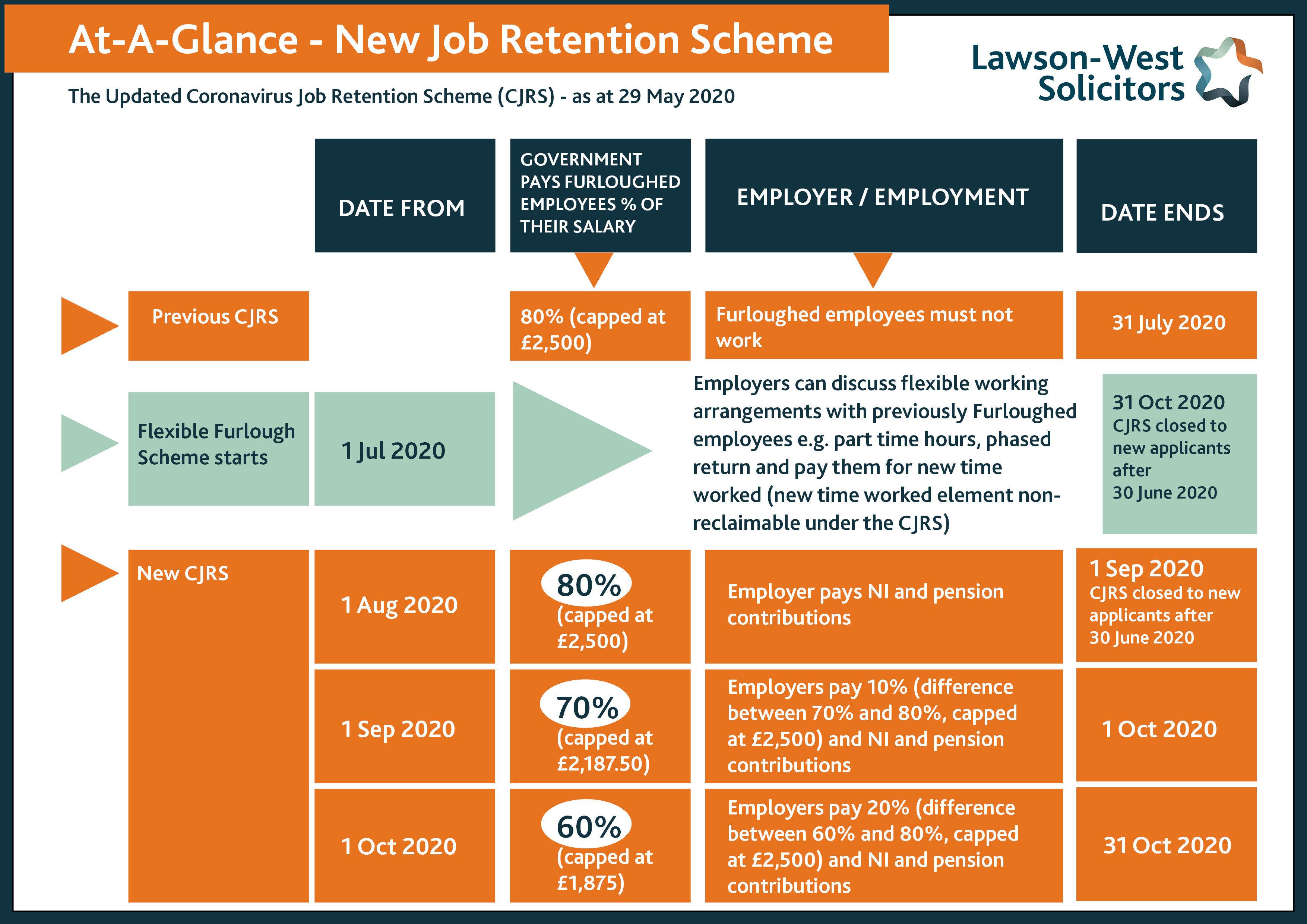

“Employers can use the furlough scheme until the end of October to receive government contributions towards employee pay, view our at-a-glance chart below and read our article on the options available to employers after 31 October.”

See our pages of information about Coronavirus for Employers here.

View all