Legal Insight: Share-for-Share Exchange

What is a 'Share-for-Share Exchange'?

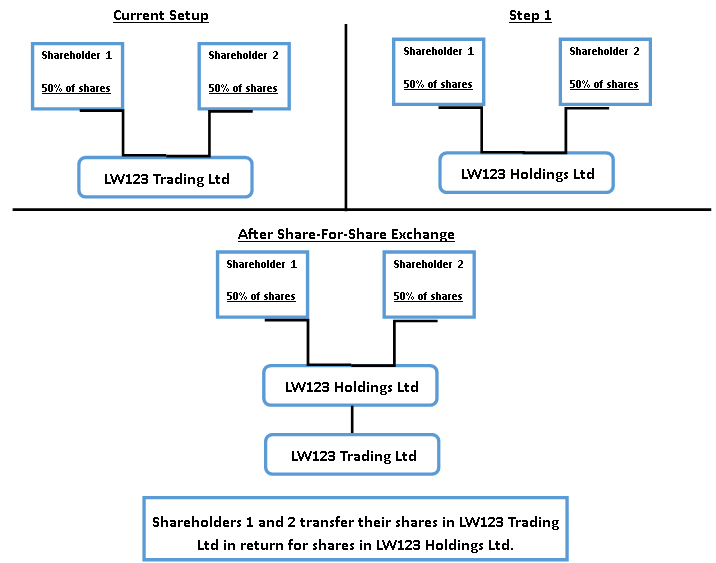

A share-for-share exchange is a process through which a holding company is created. The shareholders transfer their shares in their existing company to the newly formed holding company and in return receive shares in that holding company. The shareholders are exchanging their shares for new shares.

The first step is incorporating the new holding company. Typically, this is incorporated with the same individual shareholders. After the share-for-share exchange those shareholders will have received more shares in that holding company, which will in turn own the trading company. Typically, those shareholders will continue to hold shares in the same percentages and classes as they did in the trading company. However, new shareholders are sometimes introduced.

Reasons for carrying out a Share-for-Share Exchange

-

To protect important assets such as freehold property or intellectual property. Such assets could be transferred (hived up) to the holding company and then leased or licenced back to the trading company. In the event that the trading company suffered financially or was subject to significant litigation in the future then the assets owned by the holding company would not be available for creditors to recover against (provided the initial transfers were above board).

-

Similarly, if the trading company has accumulated large reserves of cash it may be prudent to distribute that cash to a holding company to protect it and also to avoid the trading company being considered an investment company for tax purposes.

-

It could be used to form a group structure. A new subsidiary owned by the holding company could be introduced to the group to develop a new part of the business. The separation of trade between the existing company and the new subsidiary could be prudent business planning.

-

It can be used as part of succession planning. For example, an MBO team could take a stake in the holding company with the founders receiving a combination of cash, loan notes and shares.

-

Similarly, it could be used as an alternative structure to a buyback of shares for a shareholder leaving the trading company. The continuing shareholder would receive shares in the holding company and the exiting shareholder would receive cash or loan notes (instead of shares). That cash could be paid in instalments (which is problematic for a share buyback).

-

It can be part of wider restructuring or a sale of part of the business. It is an initial step in a capital reduction demerger. By way of example, such a demerger could be used to separate the property owned by a business prior to a sale of the trading arm or to split up parts of a farming business between different family members.

Reasons why advice should be taken

It is important to take legal advice:

-

So that the share transfers are properly documented and the intended structure implemented.

-

To consider whether the company’s banking arrangements are affected and whether bank consent is required.

-

So that any Shareholders Agreement can be updated to reflect the new group dynamic and relationship between the shareholders.

-

So that any share options held by any employee in the trading company are considered; as that employee may have the right to swap their option for a new one in the holding company.

-

As it is crucial that any hive up of assets to the holding company is undertaken on a solvent basis and not by way of an illegal distribution. If not done correctly then it could be considered a transaction at an undervalue and/or the directors and holding company could be liable to repay the distribution.

Advice should also be taken from your accountant/ tax adviser on the tax implications. We understand it may be possible to apply for clearance that there will be no CGT charge on the share exchange and it may be possible to obtain stamp duty relief on the share exchange.

How we can help...

Our specialist corporate solicitors can work with you and your accountant from the outset to provide you with expert legal advice on structuring and documenting your transaction.

We have experience of undertaking various types of share-for-share exchanges and can prepare the legal documents tailored to your needs.

If you would like support or assistance, or have any questions, then please contact Rob Flannagan on 0116 212 1033 or email rflannagan@lawson-west.co.uk

View all