Key Differences Between Asset Purchase and Share Purchase

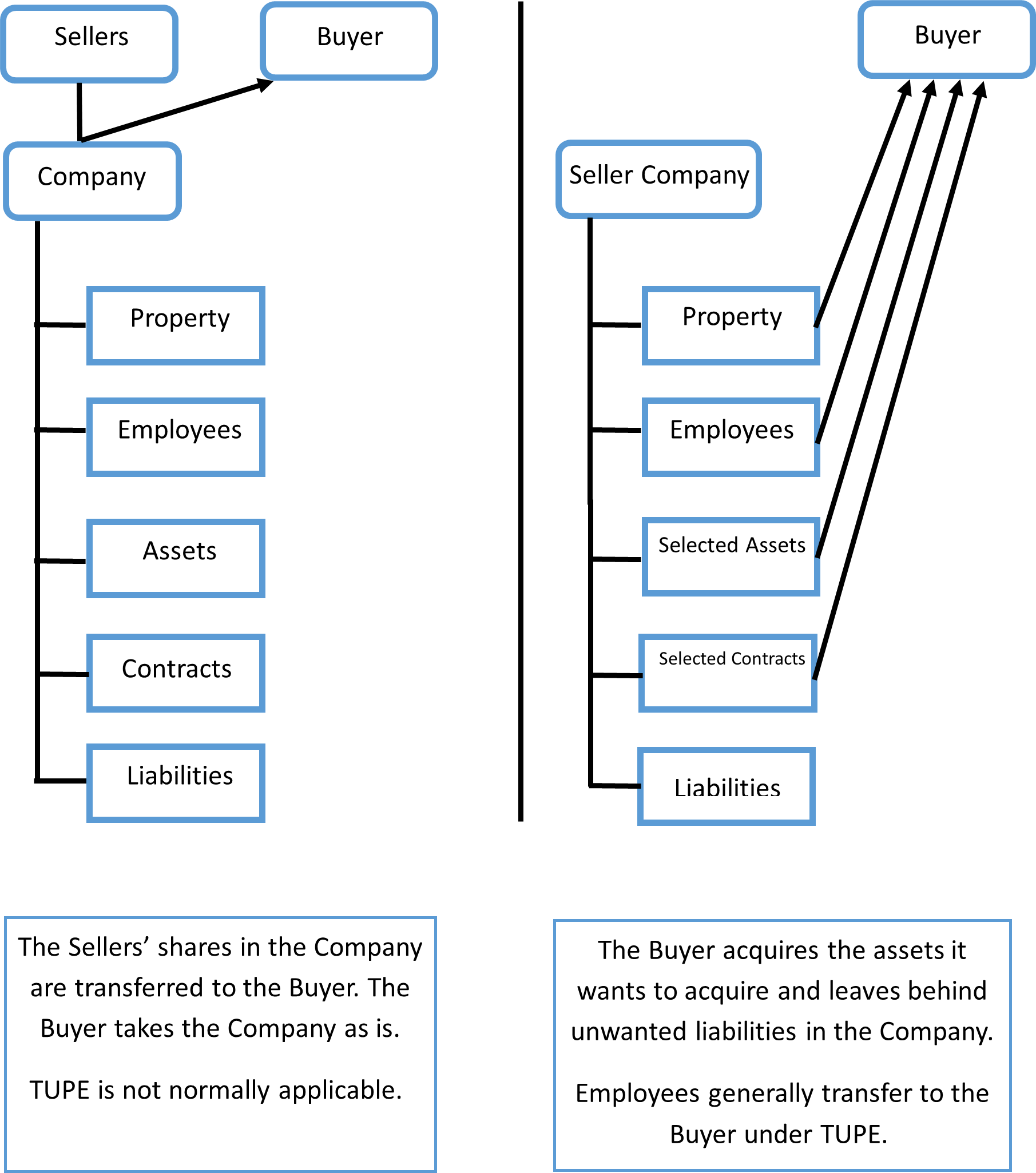

A buyer can either acquire a business through buying the shares in a company (a share purchase) or by buying the company’s assets (an asset purchase). There are differences between, and pros and cons with, the two structures; which the buyer and seller should understand before commencing the transaction.

Share purchase

A limited company has its own legal personality. It therefore owns its business, property and assets in its own right, independently of its shareholders. With a share purchase it is only the shares in the company owned by the shareholders which change hands. The buyer takes the company as is and, therefore, inherits all of its assets and, importantly, its liabilities. Liabilities could include, for example:

-

dilapidations in respect of the company’s property

-

any loans the company has taken out

-

hire purchase agreements for the company’s equipment

-

unpaid tax

We would look to address that for a buyer during the purchase process through:

-

a process of due diligence, gathering information for you to understand the company’s liabilities and to consider whether you would like to proceed or make adjustments to the deal terms; and

-

contractual protection in the share purchase agreement to make the seller liable for any undisclosed liabilities.

Asset purchase

In an asset purchase the company’ s business and goodwill are transferred to the buyer to incorporate into its own business. The purchaser can be selective about the assets it acquires and the liabilities is assumes responsibility for. The assets and liabilities which the buyer does not take over stay with the seller company.

Generally, a buyer will want to acquire the business’ name, customer and supplier list, fixtures and fittings, key contracts, logo, machinery, stock and website.

Property transaction

An asset sale may involve the sale of a freehold property, assignment of a lease or granting of a new lease. With a lease a landlord likely will require their legal fees to be covered and the buyer and seller should consider how that is to be split.

Transfer of Undertaking (Protection of Employment) Regulations 2006 (TUPE)

With an asset sale as a going concern the business’ employees have a right to transfer to the buyer on their existing terms and conditions under TUPE. Failing to do so or changing the employment terms risks a claim for unfair dismissal.

Information on the employees needs to be provided by the seller to the buyer. There are requirements for the buyer and the seller to inform and consult with their own employees and potentially appoint employee representatives.

Contracts and consents

Contracts will be required to be transferred to the buyer. This may require the consent of customers and suppliers. The consent of the provider of leased or hired equipment will be needed to novate (move) the lending to the buyer.

The business may require certain licences or approvals in order to operate. The buyer may need to go through an application process to transfer or receive new authorisation. That should be dealt with in a timely manner so that it does not hold up the wider transaction.

Overview

Share Purchase Asset/Business Purchase

Key Differences

|

Share Purchase |

Asset Purchase |

|

Can be favoured by Sellers for tax treatment and not needing to undertake a process following sale to extract the sale proceeds from the company |

Can be favoured by buyers due to flexibility |

|

The sale documents may be longer to provide the buyer with suitable protection against undisclosed risks |

Can be more cost effective |

|

Can be a longer transaction due to a greater need for legal and financial due diligence and negotiating longer documents |

Can be a quicker transaction as there may be less due diligence for a buyer to undertake |

|

The buyer takes the company as is, but the seller should be required to disclose the company’s liabilities and the buyer may change the deal terms for unwanted liabilities. |

The buyer often does not take on historic liabilities |

|

A share sale may not cause business continuity issues. Some buyers purchase companies for an already established market presence in an industry or location. |

Sometimes involves more work in obtaining consent and approvals for the business’ contracts and licenses |

|

The employees stay with the company which is being purchased. |

Employees have a right to transfer to the buyer on their existing terms and conditions. TUPE should be complied with. |

|

The buyer buys directly from the seller shareholders. |

May require personal guarantees from the shareholders of the seller company. |

If you’re considering buying or selling a business and want to discuss your options, then please contact Rob Flannagan on 0116 212 1033 or email rflannagan@lawson-west.co.uk

View all