Employee Ownership Trust (EOT)

Employee Ownership Trusts (EOTs) are a form of discretionary trust set up to purchase shares in a company; allowing employees to collectively own the company they work for. It is an exit option being considered by business owners in recent years.

Key Qualifying Conditions:

-

Trading Requirement: The company whose shares are being sold to an EOT must be a trading company or the holding company of a trading group.

-

Controlling Interest Requirement: The EOT must acquire more than 50% of the ordinary issued shares, voting rights, dividend rights and capital rights. It needs a controlling interest.

-

Limited Participator Requirement: The number of sellers claiming the EOT relief who are employees or directors (and their connected persons) cannot be more than 2/5ths of the company’s employees. EOTs are not aimed at very small family companies.

-

Employee Benefit Requirement: The EOT must benefit all eligible employees.

-

Equality Requirement: The general principle is that all of the eligible employees must benefit equally on the same terms. However, there are some factors which the trustees can use to apply the trust fund differently. These are salary, length of service or hours worked. Those factors need to be applied separately.

A qualifying sale of shares to an EOT is exempt from Capital Gains Tax (tax advice is necessary).

Provides an exit solution where...

-

It is proving difficult to find a suitable buyer.

-

The sellers may have gone through an abortive sale already. A sale to an EOT should be a friendlier process compared to a third-party sale. The sale contract may have fewer warranties and potentially leave the sellers with less residual liabilities.

-

There is a lack of a suitable management team to carry out an MBO.

-

The sellers want the company to remain independent and to retain its culture and identity

-

The sellers have concerns about the business being split up to suit an external third-party buyer’s plans. It allows for continuity of the business.

-

The sellers may be happy to continue to be involved in the day to day running of the business, while they are being paid (see below). An EOT sale likely isn’t for sellers who want to walk away/retire shortly after selling.

There are different options available to fund the purchase price...

-

Paid over a number of years, funded by the EOT itself through profits generated by the company. Often there is a longer payment term than a traditional share sale, but the overall return could be higher.

-

Using the business’ excess cash gifted to the EOT immediately after sale to provide an upfront payment.

-

Part of the consideration could involve director’s loans being satisfied.

-

Bank financing obtained with reference to the business’ performance.

There could be a mixture of the above but generally the purchase is effectively funded by the business.

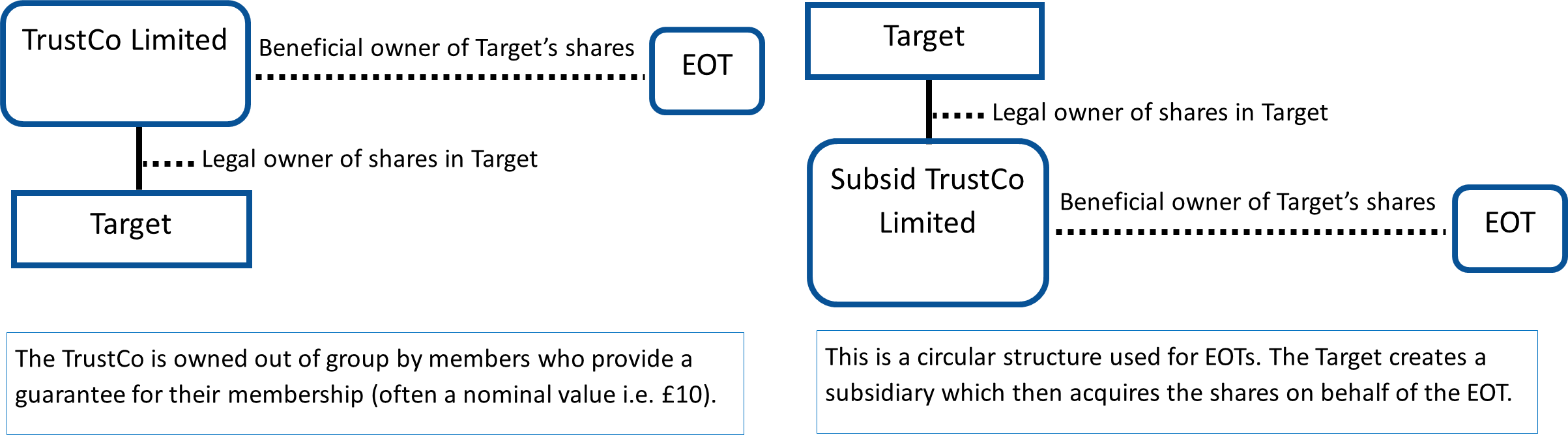

Structure:

-

Often a sole corporate trustee is used. The rationale is that if there is a disqualifying event in relation to the EOT then trustee(s) could face significant tax liabilities.

-

The TrustCo acts by its board of directors who manage the affairs of the Trust.

-

At the start the Trustco’s directors sometimes mirror the Target’s directors.

-

Each employee does not receive one share. The Target’s shares are held for the EOT for the benefit of all eligible employees collectively.

Sellers’ Security For Deferred Consideration:

-

Sellers cannot take security over the shares in the Target.

-

We have seen sellers take security over the Target itself (e.g. a cross-corporate guarantee from the Target to the TrustCo Buyer backed by a debenture over the Target).

-

An inter-creditor deed/ deed of priority would need to be negotiated with the Target’s lender regulating lender priorities and what payments are permitted to be made to the sellers.

Employee benefits:

-

Employees are able to benefit from the company’s profits once the sellers have been paid out.

-

EOTs can give staff an income tax free bonus of up to £3,600 each financial year (although national insurance contributions still apply).

-

A key element of an EOT is engaging employees and providing responsibility in decision making. This can happen over time, but effective succession planning is vital.

-

An EOT can work together with an Enterprise Management Incentive (EMI) Scheme, which is an employee share scheme targeted at key personnel.

How can Lawson-West help?

-

We can act for sellers on a sale to an EOT.

-

We can act for the bank providing lending to fund an EOT.

-

We can act for either the sellers or the bank in re-financing the deferred consideration after a sale to an EOT with bank lending.

-

We can prepare an inter-creditor deed/ deed of priority between the bank and the sellers.

If you would like support or assistance, or have any questions, then please contact Rob Flannagan on 0116 212 1033 or email rflannagan@lawson-west.co.uk

View all